The real estate world is changing because of blockchain. It’s now possible for regular people—not just the rich—to own pieces of property in digital form. This is called tokenization, and it helps solve old problems like long paperwork, huge upfront costs, and shady deals.

In the past, buying property meant you needed a lot of money and had to go through slow, complicated steps. But now, with tokenized real estate, you can buy small portions (like shares) of a property quickly, easily, and with clear records that can’t be changed.

This approach gives more transparency and trust, and opens the door for more people to invest. This article explains what these tokens are, how they work, and what real estate looks like in this new world.

In short: real estate is becoming easier to invest in—like buying stocks online—because of blockchain and tokenization.

What Is Real Estate Tokenization?#

Real estate tokenization means turning a property into digital shares (called tokens). Each token represents ownership or rights linked to that property. These tokens are created and managed using programs called smart contracts.

A smart contract is like a rulebook written in code. When conditions are met, it carries out actions—like transferring ownership—automatically, without needing an agent or lawyer. For example, if a sale is complete, the system can update the records on its own.

Most property tokens use ERC-721 (a standard on the Ethereum blockchain). Each token is unique and tied to a smart contract that records all transactions. This makes deals more secure, reliable, and easy to trace.

Example: Imagine a luxury property in Clifton, Karachi—worth hundreds of millions of rupees. Few people can buy it outright. But through tokenization, it’s split into hundreds of digital tokens. Someone with only a few lakhs can buy a token and legally own a share. The blockchain ensures every transaction is secure and transparent.

What is Crowdfunding?#

Imagine five friends want to open a small chai dhaba in Saddar, Karachi. They need Rs. 5 lakh, but none has enough alone. Each puts in Rs. 1 lakh, and together they start the shop. Profits are shared based on what each contributed. That’s crowdfunding—many people pool money to make something possible.

This connects directly to real estate tokenization.

Example: A 3-crore apartment in Clifton is split into 300 tokens worth Rs. 1 lakh each. People from different cities—or even overseas—buy tokens through a trusted platform. They now collectively own the apartment. Profits from rent or sales are shared fairly, without anyone needing to buy the full building.

Real Estate Tokenization via Crowdfunding#

flowchart TD

A["Property Owner (Clifton Apartment, Rs. 3 Cr)"] -->|"lists on"| B["Tokenization Platform"]

B -->|"splits into"| C["300 Digital Tokens (Rs. 1L each)"]

C -->|"secured by"| D["Smart Contract"]

D -->|"listed as"| E["Online Investment Opportunity"]

E -->|"buys token"| F1["Investor 1 (Teacher - Hyderabad)"]

E -->|"buys token"| F2["Investor 2 (Shopkeeper - Lahore)"]

E -->|"buys token"| F3["Investor 3 (Dubai Expat)"]

F1 -->|"gets"| G["1 Token"]

F2 -->|"gets"| G

F3 -->|"gets"| G

G -->|"recorded in"| H["Blockchain Ledger"]

H -->|"tracks"| I["Ownership + Rights"]

I -->|"triggers"| J["Profit Sharing When Property Earns or Sells"]

Step-by-Step Flow#

- Owner lists the Clifton apartment on a tokenization platform.

- Property is split into 300 tokens (Rs. 1 lakh each).

- A smart contract manages ownership and profit sharing.

- Investors buy tokens online.

- Each investor’s ownership is recorded on blockchain.

- Profits from rent or sale are distributed automatically.

How Does Tokenization Actually Work?#

Think of tokenization as crowdfunding for property. Instead of one buyer owning everything, the property is split into digital tokens. Each token is a slice of the pie.

Common Question:#

Does this mean the owner must vacate the property?

No. Tokenization sells financial rights, not the physical space. Owners can still live in the property unless they sell all rights.

Example#

Someone owns a house worth Rs. 2.5 crore but needs Rs. 25 lakh quickly. Instead of selling the whole house, they tokenize it. Investors buy digital shares worth Rs. 1 lakh each. The owner raises money but keeps the home.

Where This Helps#

- Owners: Can raise money without losing their home.

- Investors: Can enter real estate with small amounts.

- Everyone: Enjoys transparency because blockchain records every deal.

Almost any type of property—homes, malls, vineyards—can be tokenized.

Scenarios in Real Life#

Can I live there if I buy a few tokens?#

No. Owning tokens means financial rights only. To live there, you’d need to buy the majority (or all) tokens.

What if the property is rented?#

Rent is collected and distributed to all token holders automatically.

What if I want to sell my tokens?#

You can resell them on a platform, like selling shares in a company.

What if there’s conflict?#

Smart contracts prevent most issues, but big disputes may still need courts. That’s why projects often use a legal custodian.

Everyday Scenarios Table#

| Situation | Can You Use the Property? | How It’s Handled |

|---|---|---|

| Buy few tokens | No | You get only financial returns |

| Buy majority / all tokens | Maybe | Depends on contract & local law |

| Sell tokens | Yes | Sell on secondary market |

| Property vacant | No | Token holders vote on next steps |

| Want to live there | No | Only possible if you own 100% |

Types of Real Estate Tokenization#

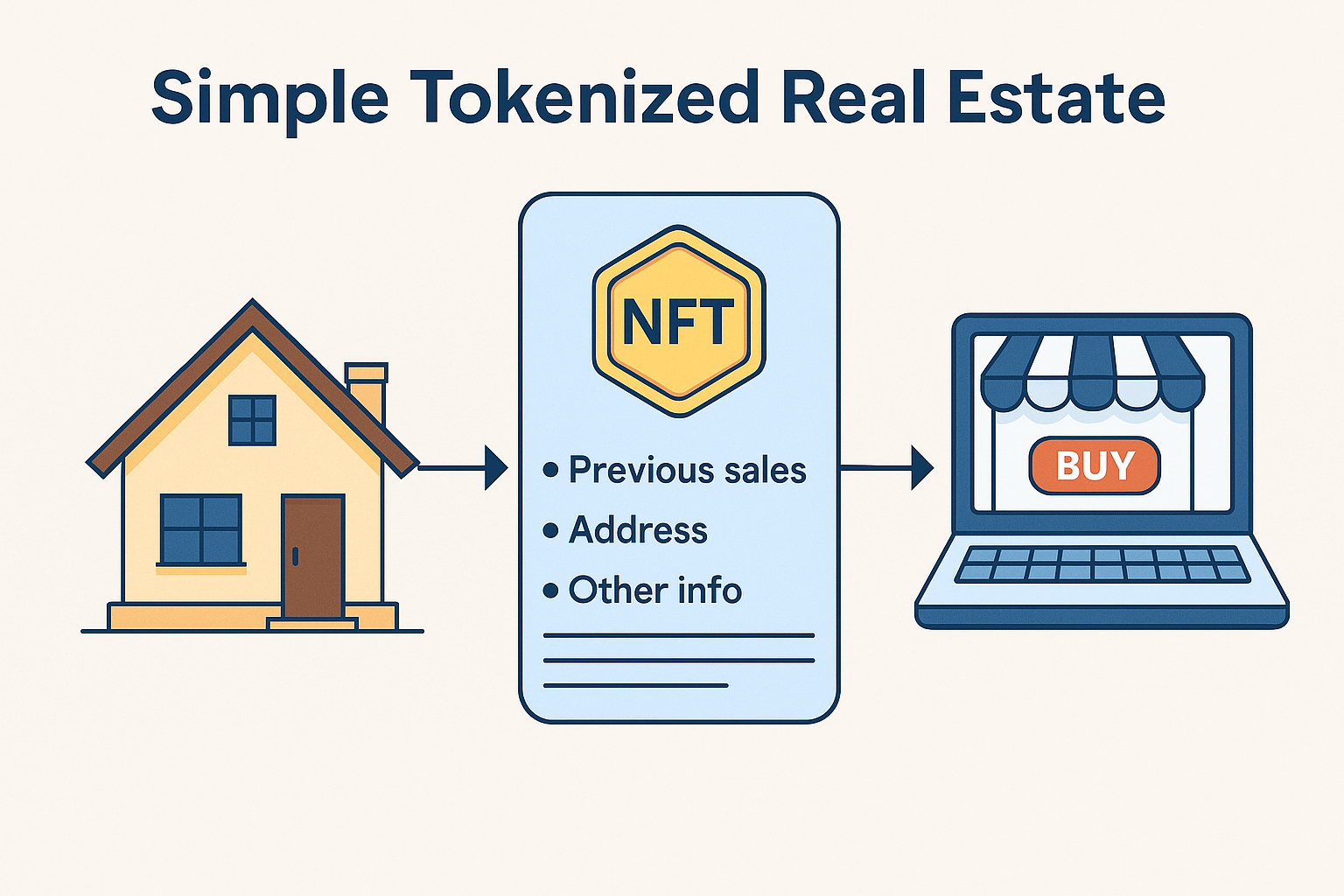

1. Simple Tokenized Real Estate (STRE)#

The basic form. One property = one NFT.

- The NFT proves ownership.

- If sold, ownership of the property changes too.

- The NFT stores property details like location and sale history.

This system is rare today because of legal hurdles, but it shows what’s possible.

2. Fractional Real Estate Tokenization (FRET)#

Instead of one property, this pools multiple properties. Tokens represent a share in the whole portfolio. This is like a digital REIT (Real Estate Investment Trust).

- Safer for investors because risk is spread.

- Tokens are fungible (like stocks), so they’re easy to trade.

- Investors don’t manage property; they simply earn profits.

Example: A “Karachi Premium Token” fund holds 10 properties across Clifton, Saddar, and Korangi.

10,000 tokens are issued at Rs. 10,000 each.

Buying 10 tokens gives you 0.1% ownership in the entire pool.

Profits are shared monthly.

Quick Comparison: STRE vs FRET#

| Feature | STRE: One Property (NFT) | FRET: Portfolio (REIT-style) |

|---|---|---|

| Ownership | One property | Many pooled assets |

| Token Type | ERC-721 (NFT) | ERC-20 (Fungible tokens) |

| Income | From single property | Pooled rent + sales |

| Investor Role | Direct fractional owner | Passive shareholder |

| Ease of Trading | Limited | Easier, like stock trading |

| Usage Rights | Not allowed | Not allowed |